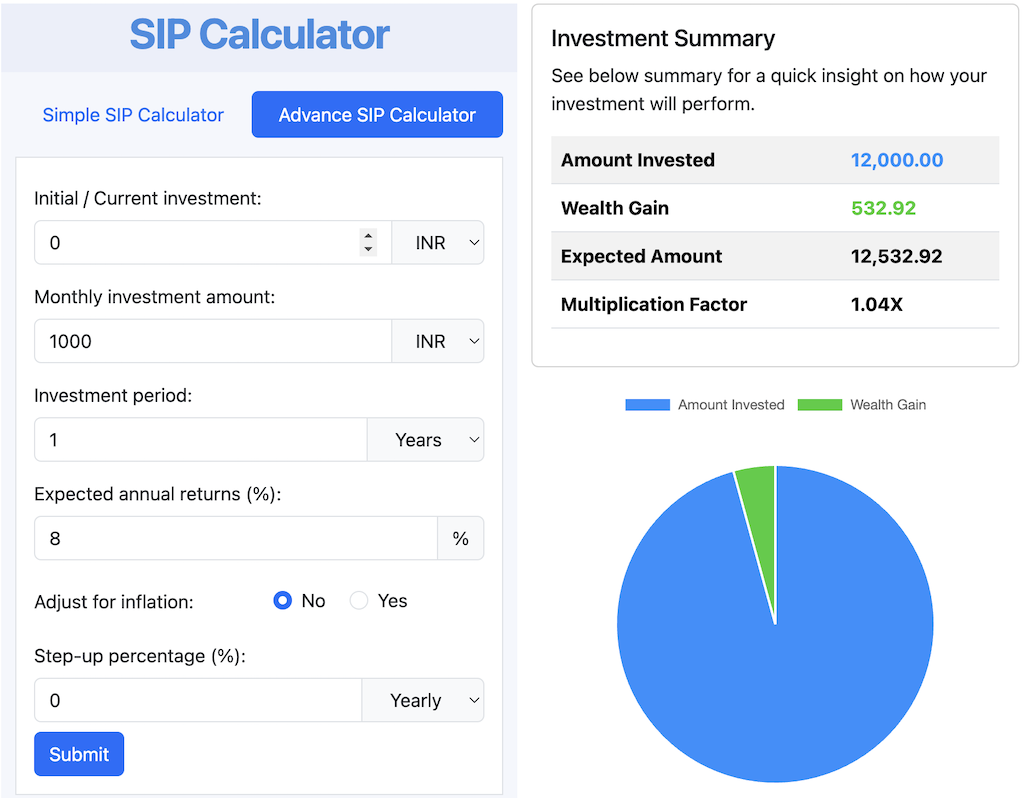

Investment Summary

See below summary for a quick insight on how your investment will perform.

| Amount Invested | INR 12,000.00 |

|---|---|

| Wealth Gain | INR 532.92 |

| Expected Amount | INR 12,532.92 |

| Multiplication Factor | 1.04X |

| Month | Investment | Interest | Balance |

|---|---|---|---|

| Month 1 | 1,000 | 7 | 1,007 |

| Month 2 | 1,000 | 13 | 2,020 |

| Month 3 | 1,000 | 20 | 3,040 |

| Month 4 | 1,000 | 27 | 4,067 |

| Month 5 | 1,000 | 34 | 5,101 |

| Month 6 | 1,000 | 41 | 6,142 |

| Month 7 | 1,000 | 48 | 7,189 |

| Month 8 | 1,000 | 55 | 8,244 |

| Month 9 | 1,000 | 62 | 9,305 |

| Month 10 | 1,000 | 69 | 10,374 |

| Month 11 | 1,000 | 76 | 11,450 |

| Month 12 | 1,000 | 83 | 12,533 |

SIP (Systematic Investment Plan) could be one such technique that will make sure that you have a decent income/wealth when you are no longer physically or emotionally capable of going through the daily grind. For many, SIP can be immensely beneficial towards achieving the goal of financial independence or early retirement dream. In the next few sections, we will go through several topics related to SIP and try to uncover most of the related knowledge.

Please note that this is not a financial advice. As the circumstances of life play a big role in the way we plan our investments, it is better to consult a financial adviser before you start your investing journey.

What is an SIP Calculator?

The SIP calculator at SIPCalculator.org is a free easy-to-use online calculator that takes away any manual calculation efforts and helps you focus better on your investment planning. It brings out the right insights including the final wealth you will have, interest earned over time, month-by-month, and year-by-year investment growth during your investment journey.

You can use our calculator for all of the below calculation scenarios and needs:

- SIP calculator with lumpsum investment.

- SIP calculator with lupsum investment and inflation adjustment.

- SIP calculator with monthly or yearly investment frequency.

- SIP calculator with step-up or top-up.

- SIP calculator with step-up or top-up and inflation adjustment.

- Mutual fund SIP calculator.

- Gold SIP calculator.

What is SIP?

SIP (Systematic Investment Plan) is an investing mechanism in which a fixed amount of money is periodically invested in a financial instrument such as mutual funds, gold, etc. The investing frequency can be weekly, every 2 weeks, monthly (most popular), or quarterly, etc.

SIP itself is not a financial instrument that you can invest in, instead you use SIP as a technique for investing in Mutual Funds, Gold Investments, Equity Stocks, Retirement Account, etc. If you are investing regularly and at a set frequency you are doing an SIP.

Is mutual fund same as SIP?

The answer to that is No. SIP and Mutual funds are two separate things. SIP is an investing technique, while Mutual Fund is an investment instrument. This means that you can also do SIP in assets such as Equity Stocks, Bank schemes, Gold Investments, etc.

However, recently SIP has started gaining popularity as a direct replacement for SIP in Mutual Funds.

In which assets can we do SIP?

SIP can be done in Mutual Funds of all types (Debt, Equity, Hybrid, Index, and Sectoral etc.), in Equity Stocks, Bank provided saving schemes, and gold investments.

How does SIP work?

Let’s understand this with an example of SIP for Mutual Funds. Assume that you open an SIP for a mutual fund using an Investing Platform of your choice. A fixed amount will get deducted from your bank account on every SIP date and will be invested in the selected mutual fund. The additional mutual fund units purchased with every SIP will start reflecting in your Demat account within next 2-3 market days.

So, if Mr. X opens a monthly SIP of USD 500, his bank account will get debited by this amount on 1st of every subsequent month and he will get mutual fund credited in his Demat account within next 2 to 3 market days.

SIP contributions can be set to end after a specific date or can be made never ending, also known as perpetual SIP.

How is money deducted from bank account for SIP?

Investing platforms require the investor to create Bank Mandate or Standing Instruction (SI), allowing them to deduct a fixed amount of money from bank account on SIP date. A bank mandate or standing instruction can be easily created with the help of Netbanking and requires no physical visit to bank.

Some platforms also allow investors to deposit SIP money through other means such as Netbanking, NEFT, and Unified Payments Interface (UPI) transfer.

When having multiple SIPs, it is easier and recommended to setup a bank mandate to fully automate the investments. This also reduces the chances of missing an SIP investment due to non-payment of investment money.

What is the right time to start an SIP?

SIP offers many advantages as we will explore below, but one of its main benefits is compounding effect on interest generated. Compounding effect can be absolute game changer over longer investment periods, and thus starting early even with smaller SIP amount can generate significant wealth for investors.

When investing in SIP, one should follow the mantra of “Start early, Invest regularly!”

How does SIP Calculator work?

The SIP calculator at SIPCalculator.org works by providing multiple options such as Monthly Investment Amount, Investment Period (Years or Months), Expected Annual Return percentage, Inflation Adjustment in Simple SIP Calculator mode, and other advanced options such as Initial or Current Investment value, Inflation percentage adjustment, Step-up percentage and Step-up frequency options in Advance SIP Calculator mode.

These fields and options are easily understandable and come with certain initial values to ease you into a better understanding of how to use the calculator.

Further, a SIP calculator works on the following formula to calculate final amount at maturity:

M = P * ({[1 + i] ^ N – 1} / i) * (1 + i)

Meaning of symbols in above formula is as below:

- M is the final amount you would receive upon maturity.

- P is the amount you would invest at regular intervals, also called principal.

- N is the number of payments you would make.

- i is the rate of interest.

Let’s say you want to invest 1,000 per month for 12 months at an annual interest rate of 12%, then the monthly rate of return will be 12/12 = 1% (i.e., 0.01).

So, the total amount at maturity would be, M = (1000) * ({[1 + 0. 01] ^ {12} – 1} / 0. 01) * (1 + 0. 01) = 12,532.92 approximately. You can simply use our calculator to fill in all these values as shown in the below image.

What are the advantages of SIP?

The biggest problem individual investors go through is basing their investment decisions on market predictions, random stock advice, or a news clip or viral video. They do it without understanding the fundamentals of investing and lack the required knowledge depth. Thus, often leading investors to:

- Time the market or investing based on uninformed hunch.

- Making exits when they could have made better returns by staying invested, or

- Booking/Realizing losses

This is where SIP as a systematic and disciplined investing technique can help investors stay away from their own biases, emotional ups-and-downs, and non-solicited advice. Some of the advantages of SIP are as below:

Disciplined Approach: SIP means investing at a regular and pre-determined frequency. This takes away the guesswork and choices about should I invest this month or not and makes an investor more disciplined about investing.

Convenient & Hassle Free: SIPs in mutual fund are managed by large corporations and experienced industry professionals approved by country-specific regulatory authorities. Thus, if you do not have time to constantly manage your stock portfolio or have a full/part-time job, think of SIP as hiring a full-time wealth manager to work for you.

Rupee or Dollar Cost Averaging: The mutual fund unit price or NAV (amount you pay to get 1 unit of a mutual fund) varies as per the market movements and thus you get different units every month even when investing a fixed amount.

For example, let’s say a mutual fund is priced at NAV USD 100 (i.e., per unit), and you are investing USD 500 per month, you will receive 5 units of the Mutual Fund in first month. Now, if the NAV of mutual fund increases to USD 110 in next month, the additional units you will receive would be 4.54 (i.e., 500/110), and subsequently if the NAV of mutual fund declines to USD 90, you will receive 5.56 (i.e., 500/90) additional units. As you can see, for a fixed amount SIP, more units get purchased when the NAV is low and less units are purchased when the NAV is high.

Calculating average unit cost of purchase after 3 months comes to USD 99.34. This is called Dollar-Cost-Averaging (DCA) or Rupee-Cost-Averaging (RCA). In simpler terms, while you could not have controlled the market movements, the SIP method of investing can protect you from sudden ups-and-downs and generate a steady annual return of 8% or higher (8% is the historical average return of major stock markets over 10+ year investment duration)

Compounding Effect for Long Term Wealth Creation: Power of compounding can create wonders for long-term wealth creation. Compounding happens when the interest earned on principal investment starts earning additional interest on itself, thus generating higher total interest over time. Disciplined investment through SIP can be helpful for creating wealth over the long-term and can have life changing impact for investors. Allowing for more personal time, lesser-hassle, reduced worrying, financial independence, early retirement option, these are just a few benefits of the long term impact an SIP can have for a disciplined investor.

- Diversification: It is more of a benefit of mutual fund then of SIP. Diversification in context of mutual fund indicates how a mutual fund invests in much more than one company/stock, thus safeguarding your money against an unforeseen negative event at market, sector, or individual stock level. This is well aligned with the principal of “Not putting all your eggs in one basket.”

Liquidity: Most of the SIPs do not have any lock-ins except for Equity Linked Saving Scheme (ELSS) type. This means that you can instantly withdraw your money from the SIP and same gets credited in 1 to 3 days to the bank account. Please note that depending on fund type and investment duration there could be some Exit Charge and you must check for it while making the withdrawal. Also, you may have to pay taxes on the profit made from the investment.

Start Small: An SIP in mutual fund can be started with a very small amount such as INR 500 in India or USD 100 – 500 in USA and similar amount in other countries, depending on the selected scheme. The benefit of SIP lies in investing over long period of time and a monthly SIP of INR 500 done for 10 Years could create a wealth of INR 92,082 with INR 32,080 as the profit/wealth generated.

What are some mistakes to avoid when starting an SIP?

With the rise of internet era, easily available financial education, marketing, and technological advancements, it has become very easy to start SIP investments. However, every one of us has their unique commitments, needs, and goals and thus it is required that you plan for yourself and not simply follow the herd. For better and effective planning, you should consult a financial planner, but for the curious mind you must address below points:

Identify your goals: Investing without goals is like travelling without a destination. You may have goals like buying a care, buying a house, higher education for kids, foreign vacation, retirement savings, etc. etc. Each of these goals require a certain amount of money to be saved within a fixed time duration and knowing this can help you identify your risk appetite, investment duration, SIP amount, and expected annual return.

Determine your risk appetite: Different investors have different risk appetites, some prefer being conservative and are satisfied with a relatively less but more certain return percentage, while others prefer taking risk for a higher percentage return. You must figure it out for yourself, based on your goals and investment duration. Historically, the risk reduces as the investment duration increases.

Proper fund research: Make sure to thoroughly research the riskiness, asset class (equity/debt/hybrid/etc.), historical performance, exit load, expense ratio, and any other associated charges when investing in Mutual funds.

Monitor your SIP: SIP is hassle-free, but still requires monitoring and should not be left unmonitored for longer durations. Depending on the fund performance and your changing needs you may want to re-allocate your investments to a better performing fund or asset class.

How can our SIP Calculator help you?

Our SIP calculator is a thoroughly tested, and a visually appealing calculator that works with all devices and screen sizes to help you calculate your returns or advise your clients. It allows you to share the calculations with others and they will see the same values as you filled in. Feel free to bookmark the tool/webpage and recommend or share to others to create financial awareness for everyone.

Advantages of using our SIP Calculator

Using our SIP calculator, you can:

- Easily calculate the returns/profits and financial wealth at the end of investment period.

- Adjust your SIP returns and planning against inflation.

- Calculate returns from Step-Up SIPs easily.

- Share your calculations with your family, friends, clients, and social groups.

- Generate insightful and appealing visuals of your SIP investment portfolio.

- Get a Month-by-Month and Year-by-Year progress throughout your investment journey.

What are the risks of SIP?

As discussed above, SIP is just an investing technique so there are no direct risks of SIP. However, depending on your choice of investment you may need to be careful and safeguard yourself by either distributing your assets in multiple mutual funds, or multiple bank accounts in case of FD/RD, long-term and short-term investments (e.g., Liquid mutual funds), high or moderate or low risk instruments (debt mutual funds), etc.

It is highly recommended to consult a certified financial planner or do your own thorough research before investing.

Do we need to pay taxes on SIP profit?

Well, yes. Just like other financial instruments you are liable to pay taxes on the profits you make from investing, however the amount of taxes may vary by your tax-slab and investment holding period. Mostly, the longer you hold an investment the lesser the taxes, this is as you avoid a lot of intermediary taxes and other charges caused by selling and buying multiple times. Also, any amount that you would end-up paying in these taxes or charges, would otherwise keep compounding along with your investment.

What are the benefits of SIP over Lumpsum investment?

If you have a large amount of lumpsum money maybe from selling a house or from your PF contributions, please do a thorough research and even take help from a certified financial planner to invest it towards your future. Note that, if you keep holding to a larger sum only to invest it every month or week using SIP, you are likely to lose on some returns due to the initial waiting period before all your lumpsum money is invested. Lumpsum investments carry significant risk and thus proper planning is required.

However, if you have a limited amount of investible money every month then opt for an SIP into mutual funds or other safer instruments of your choice.

Other SIP FAQs:

Finally, some articles/references from around the web:

- Reference: SIP Full Form

If you don’t find a way to make money while you sleep, you will work until you die.